In Defense of Jeremy Johnson

27 Jan 2011 :: by sd :: Comments

“I’m not guilty!”

Squeals Jeremy Johnson in re Jeremy Johnson on iworkslive.com :: a now disappeared website that Johnson put up shortly after the FTC sued his sorry ass for $275 million dollars worth of soul sucking. Most of Johnson’s sites are still up :: but this one came down after just a week or so :: probably after one of his attorneys said something like :: “So I guess you’re stupid then? You WANT to go to fucking jail or something? You have the right to remain SILENT … ever heard that?”

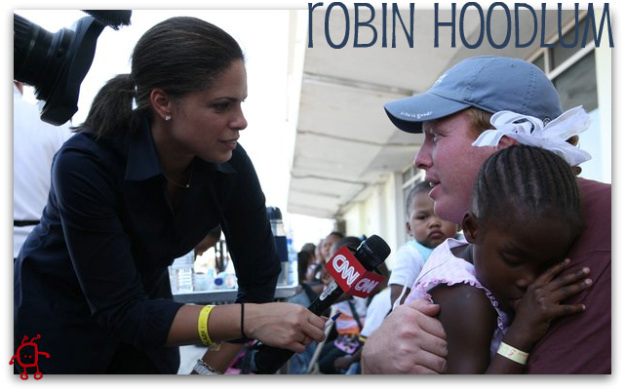

So he took it down like a good badboy … but I saved it … cause that’s the sort of shit I do. The site had three pages :: and used an unmodified version of the “CNN & Black Baby” propaganda pictured above.

Make sure to notice our new not-friend Utah Attorney General Mark Shurtleff making yet another dazzling appearance in his role as useless sellout. But more on that later …

Reprinted in full :: for the Google record :: without remark {except for those remarks}.

{begin quote :: emphasis original}

FTC Hypocrisy and Lies / Abuse of power by the FTC

Claim: iWorks illegally charged recurring billing to customers without written authorization.

Truth: Hundreds of companies charge recurring billing without written authorization, including Netflix, Amazon.com, and online games such as World of Warcraft. Written authorization has never been a requirement for recurring billing, until the FTC decided that iWorks and iWorks alone was in violation of a non-existent “law”.

Claim: People who bought iWorks products didn’t know what they were being charged for.

Truth: this is provably untrue. iWorks used the very standards set down by the FTC. Furthermore, iWorks has thousands of customers on record who cancelled their memberships before the Trial period had ended. This would be impossible if iWorks clients “didn’t know” what they were being charged for.

Claim: iWorks was somehow behaving “unethically” by using a Public Relations service.

Truth: This is another example of the twisted “logic” being used by the FTC in their witch-hunt against iWorks. Nearly every company in the world uses some form of Public Relations Management. Yet somehow, when iWorks engages in a simple business practice that close to 100% of all businesses also use as a business tool, iWorks is “in the wrong”, according to the FTC.

Claim: Chargebacks are proof that customers didn’t know that they were being charged.

Truth: Chargebacks are proof that the customers absolutely DID know that they were being charged. Simple logic dictates that a customer would have to be aware of a charge before they could charge it back through their bank. Furthermore, the Wall Street Journal ran an article on how chargebacks (or ‘Friendly Fraud’, as they call it) have crippled Online Merchants. Companies such as Verifi specialize in nothing but chargeback prevention.

Claim: iWorks tried to ‘blackmail’ customers who Charged Back by threatening to blacklist them.

Truth: Of all the claims made by the FTC, this is perhaps the most ridiculous. iWorks maintained a “Scrub” list intended to make sure that customers who charged back couldn’t purchase their products in the future. Almost every business does the same. If iWorks were really intent on “charging people without their knowledge”, as the FTC claims, why would they PREVENT people from purchasing their products? The truth is that iWorks absolutely did not want to charge customers who were not aware of the terms of their offers.

Claim: iWorks sold Grant assistance knowing that the Government doesn’t actually provide Grants to people.

Truth: It seems odd that the FTC would claim that the world’s largest Grant provider (the Federal Government) doesn’t actually provide Grants. But that aside, iWorks consistently stated in their marketing material that they provided information on over 70,000 Private Grants. iWorks has documented proof and uncontested testimonials from clients who did indeed receive Grant money.

Claim: Negative Option Marketing is “fraudulent”.

Truth: Again, the FTC only seems to consider Negative Option Marketing “fraudulent” when iWorks does it. Literally thousands of major companies, including FreeCreditReport.com, Amazon.com, American Express, Dish Network, and nearly every Cable Television, Cell Phone, and Internet Provider in America uses or has used Negative Option Marketing. iWorks can show that the methods they used to market their products were identical (and in many cases superior) to the Negative Option offers used by these other companies.

Claim: iWorks tried to avoid FTC regulations.

Truth: iWorks attempted for more than two years to get the FTC to establish clear and consistent rules for Online marketing. The FTC refused. It became increasingly apparent that the FTC doesn’t exist to protect consumers; it exists to destroy small businesses. The FTC would never dream of suing American Express or Amazon.com, because those companies possesses the resources to defend themselves.

Who is Jeremy Johnson?

Prior to the FTC attacks, Jeremy Johnson was mainly known as a philanthropist and humanitarian, whose selfless efforts had aided literally thousands of people in need. Jeremy assisted local Search and Rescue teams at his ow n expense, in some instances risking his pilot’s license and even his life in service of his community. He was featured in magazines such as the Readers Digest for his heroic efforts to save life and property during Utah’s devastating floods and wildfires from 2003-2011. His efforts to help build schools and orphanages in earthquake-shattered Haiti were featured on CNN. He was a businessman who employed hundreds of people throughout Utah. He was also a business owner who attempted to run his business ventures by the best standards and practices available from the FTC. Unfortunately, he soon realized that the FTC doesn’t exist to provide guidelines or assistance. They exist to cripple free enterprise. The truth is that iWorks and Jeremy Johnson constantly attempted to obtain clarification of Negative Option Marketing Law from the FTC, only to find that the FTC doesn’t want to provide clear guidelines. Providing clear guidelines would prevent them from doing what they really exist to do: destroy companies and businessmen who somehow stray over an imaginary line that only the FTC knows exists.

About iWorks

The story of I-Works is the story of a group of young entrepreneurs who built a company up from nothing to become a multi-million dollar success story, only to see it destroyed by the overzealous harassment of a government agency run amok.

In six years, I-Works grew from just fifteen employees to a national corporation employing hundreds of employees, and benefiting entire communities throughout Utah. iWorks became the major employer in the Utah city of Ephraim. Yet they, along with so many other innocent workers and their families, lost their jobs during the worst economic crisis in modern U.S. history; all due the arbitrary actions of one rogue government agency.

The irony is that I-Works had spent literally millions of dollars and thousands of man-hours trying to ensure compliance with FTC regulations. At any point over the past four years, the FTC could have avoided hundreds of lost jobs and saved millions of dollars in taxpayer money, merely by placing a single phone call.

I-Works was established in June of 2000, predominantly dealing in marketing over the telephone. In 2004 I-Works began entering the online marketing arena and worked closely with a couple product developers to market highly popular content online. In 2006 it terminated all phone marketing and focused entirely on the internet marketing arena. In the beginning it was a fairly new market, with no real clear cut regulations. As more advertiser came into the market it became evident that there were people striving to “do it right” vs. others that didn’t care, and were just after the “easy money”.

For those of us trying to follow any existing regulations we found that even the regulators themselves were struggling to determine what the regulations should be. Most regulations were based off of older styles of marketing and did not really apply. In 2006 we had a law firm review our advertisements and made some adjustments to ensure that we were “in line” with the current “best practices”. In an effort to stay on top of any new regulations, the owner and General Manager flew to Washington DC to attend an FTC Negative Option conference, in January of 2007. Everyone in attendance was trying to figure out what the regulations are, and should be, in order to continue with a legal practice of Negative Option advertising, while protecting the end consumer. The FTC’s main guidance was a general statement that disclosures should be “clear and conspicuous” and “within the vicinity of the order submit button”. Everyone was left to interpret what that actually meant. This forum was not published until Jan 2009 and if one reads it in its entirety it is clear that it was full of many ideas and suggestions but there were still a lot of questions and things to be worked out. Upon returning from the conference the owner elected to pull our advertising to review all sites and correct any issues that might not be compliant. We saw a significant drop in sales for some time as we found it difficult to get affiliates to run our offers because we were told they were “too compliant.”.

Suddenly, and without any notice we found ourselves in the cross hairs of the FTC when on February 26, 2010 we received a 47 paged Civil Investigative Demand, asking us for every document that we could produce from January 1, 2006 to present. Alleging that through our entire time in business we had been purposely defrauding customers, that we were not compliant, and that our products were not as claimed. None of these accusations match the facts of what we did as a company.

I-Works, as a marketing company, continually worked to ensure its advertisements were compliant by gathering information obtained from Forums and any legal cases that might have come out from another advertiser that got into trouble with the FTC. The main focus of these investigations was lack of disclosure and false advertising. Every time we reviewed these cases, we found our sites to closely follow the “Clear and Conspicuous” guidelines. We would make further adjustments to our sites as necessary to ensure continued Compliance.

As further testament to I-Works efforts to be in compliance we invited the Attorney General of Utah, Mark Shurtleff, in first part of 2009, to visit our offices and to see our products and processes. After the presentation he called our employees together and told them “that they should be proud to work for a company like ours” because we were doing it right, unlike other companies he had seen.

In addition, in May 2009 we invited two investigators from the division of consumer protection of the state of Utah to see the same presentation in our office and they also said they were very impressed with what we were doing.

Our contention is that the FTC has begun to implement a strategy that “everyone is guilty until proven innocent”. The FTC, when “investigating”, has a predetermined outcome and ignores any evidence to the contrary. In addition, if they would simply inform a company that there is a concern they would instantly make the change, thereby saving hundreds of thousands of dollars, jobs and tax payer money.

This presentation is a very brief history of the extreme measures that I-Works has taken over the years to strive to be compliant with laws and regulations. It stands apart from all others in the industry. None have even come close to providing the valuable information found in the products that we were marketing and few, if any have implemented similar policies and procedures. We will also show that there were many forces outside of our control that contributed to some of the negative things the FTC alleges.

Truth vs Fiction

There are two stories being told, and only one can be true. The FTC is trying their hardest to paint I-Works as an elaborate fraud.

-or-

The Real Story.

I-Works entered a market in which it had no previous experience. There was an ongoing learning experience dealing with unclear regulations. I-Works was continually striving to do the very best, in an ever-changing business market, to ensure that the consumer was fully aware of what they were purchasing and given every opportunity to have a satisfied experience.

The FTC, in its own published workshop, admits that: “…users click through WebPages quickly, without paying much attention because they want to complete a given transaction…as a result…users do not read…the terms of agreements they enter into online.” -FTC Negative Option Conference, 2007

The accusation that we are scammers is false.

The accusation that any of our clients were ever defrauded is false.

The Demand that all of the top employees in the company turn in a list of all of their personal assets because the FTC will be coming to take everything we own including our homes, personal belongings, and then ban us from ever working in what we have learned over the last 8 years is draconian and we need help to stop an out of control government agency that has let its power go to its head.

{end quote}

>> bleep bloop

comments